High Tuition Costs and Reduced Public Education Funding

Biden has been under increasing pressure for some time to address the student loan debt crisis, with some U.S. officials constantly urging him to issue broad forgiveness. However, both political spectrums, analysts, and U.S. officials are concerned about the impact of the forgiveness plan on inflation, as eliminating student debt would inject more money into the economy. Others have argued that while this aid could help many people, it doesn’t address the more fundamental issues of high tuition costs. Some economists have even warned that this action could encourage colleges and universities to increase costs with the federal government’s approval of this bill.

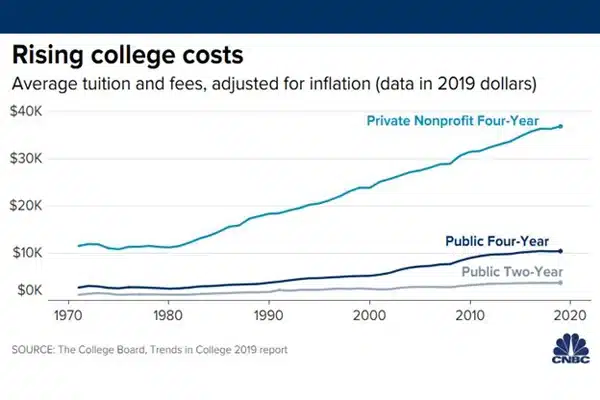

However, outstanding student loan debt is only part of the problem. The rising cost of education in this country and the excessive accessibility of federal loans are the main drivers behind the expansion of this crisis. In fact, the primary forces fueling this growing debt are the increasing costs of education and the greater availability of federal loans—both of which are worsened by stagnant wages.

Tuition costs, in and of themselves, constitute a crisis—one that William J. Bennett, former U.S. Secretary of Education, foresaw decades ago in 1987. In an article that year, Bennett stated:

“Increases in student financial aid in recent years have enabled colleges and universities to raise their tuition rates with confidence, knowing full well that federal loans will help offset these higher costs for students.” 1

Increase in Indebted Students Due to Rising Tuition

Tuition costs in America have doubled compared to two decades ago, growing annually by about 6.8% according to The Education Initiative. Data shows that the average cost to attend an in-state public college is around 25,487 per year. Students attending private colleges pay nearly double the average, around 53,217. Based on Georgetown University’s data analysis in fall 2022, university cost increases have been far greater, rising over 100% in the past four decades. Overall, between 1980 and 2019, student tuition costs increased by 169%, while wages for young workers aged 22 to 27 only rose by 19%. U.S. Department of Education surveys show that a typical undergraduate student with loans now graduates with nearly $25,000 (or more) in debt. According to the Urban Institute’s analysis, state funding allocated to student education has steadily declined. Also, only about 60% of higher education costs are covered by the government, a significant drop from around 70% in the 1970s.

The amount of student debt in America is roughly equal to the size of Brazil’s or Australia’s entire economy. Based on official U.S. government data, over 45 million people collectively owe more than $1.6 trillion in debt. Meanwhile, the number of indebted American students continues to grow! Notably, right now as you’re reading this, over a million people are joining the ranks of indebted American students.

Biden Administration’s Promise to Solve Students’ Problems

These figures have been increasing over the past half-century due to the continued rise in higher education costs. Tuition growth has been significantly higher than increases in other American family expenses. This upward trend in tuition costs occurs while the government allocates far less budget to this matter than in previous years. To combat this growing crisis, Biden proposed a plan to eliminate significant amounts of student debt for millions. According to him, this is a step toward fulfilling his campaign promise to reduce the unsustainable economy that has plagued generations of Americans. He said: “This burden is so heavy that even if you graduate, you may not have access to the middle-class life that a college degree once provided.”

Turning Student Debt into Economic Bankruptcy

Earning a bachelor’s degree in America increases an individual’s income by up to half a million dollars (or more). On the other hand, students must rely on student loans to cover tuition costs, but repaying these loans should be fair. Typically, an American student’s debt after graduation is about 37,000, which with 7% interest over a 25-year period, reaches 78,000. In some cases, the individual may have to repay four times the loan amount.

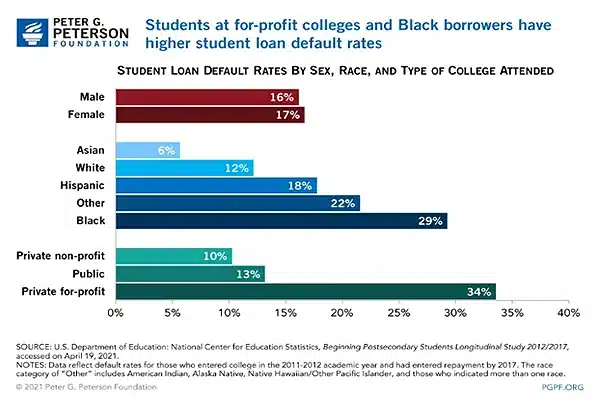

In addition to this, about a million American students annually default on their payments because they simply can’t afford them, meaning their life and future are essentially ruined. In this regard, their monthly salary is deducted from their account until they can no longer pay taxes, their financial and credit records are destroyed, and they may even face IRS penalties for non-payment. All this is because banks, credit companies, and influential groups have manipulated the system so that even if a person declares bankruptcy, they can’t escape the bad conditions that arise after defaulting on payments.

This situation is only for student loans. Congress could reform laws to make student loans like regular loans, but they don’t; why? Because their services are for large loan-granting companies, not for the people.

Legal Corruption in America and Lobbying

Recently, presidents and managers of large loan-granting companies, along with the Chair of the U.S. Congress Education Committee, held four sessions on their private jet to ensure the consolidation of relations between them. The Chair told them: “Know that I am always your supporter and backer.”

This is usually considered corruption and is completely legal in America today. To combat it, there’s a law called the “Anti-Corruption Act” that prohibits gifts from influential lobby groups to politicians. It also eliminates what’s called the revolving door (a method where lobbyists hire former Congress representatives and staff). But Congress will never pass this as a federal law because it would act against its own interests. Addressing current overdue debts may reduce the financial burden on millions of borrowers and free up their income for needed purchases like cars or homes. However, without reforming the flawed structure, this move won’t prevent future borrowers from entering the same debt crisis.

Efforts by Student Loan Companies to Increase Students’ Debt Burden

On the other hand, student loan companies in America spent over 6 million from 2020 to mid-2021 on lobbying Congress representatives to pressure the government to postpone or completely cancel student debt repayments. The Biden administration, and Trump before him, have repeatedly postponed student loan repayments for various reasons, including the COVID-19 pandemic, giving students opportunities. Meanwhile, top companies managing federal loans spent over 4 million in 2020 and about 2.4 million in the first few months of 2021 on lobbying among Congress members to advance their interests. These companies’ task is to guarantee federal loan contracts and receive commissions for each loan provided to students. Navient Corp, one of America’s largest student loan companies, spent over 1.7 million on its lobbying efforts in 2020. This figure was over $970,000 in the first few months of 2021. The amount this company spent on congressional lobbying and influencing for gains has been higher than any other group since 2015.

Troublesome Monopoly of Loan-Granting Companies

The monopoly of student loan-granting companies in 2020 even worked against the “Student Loan Forgiveness Fairness Act,” which initially suspended loan grants and debt collections from students; moreover, they managed to lobby to turn the tables in their favor. Their actions aimed at reducing the government’s grace period for students and increasing loan amounts to them. These actions even include lobbying to cancel the grace period for student loan repayments during the COVID-19 pandemic.

Navient has been investigated in recent years for misconduct in granting loans to students. In March 2021, the company lost a multi-year lawsuit against the Consumer Financial Protection Bureau and was convicted. According to the bureau, this lawsuit caused students hundreds of thousands of dollars in losses by steering them toward more expensive payment plans. In the same year, the Pennsylvania Attorney General sued Navient for “engaging in unfair and deceptive lending and failing to provide appropriate repayment programs to students.”

Corrupt Connections Between Companies and U.S. Officials

A private financial institution called Sallie Mae Corporation operates in providing student loans. This institution has spent large amounts in recent years on lobbying and influencing American authorities and decision-makers. The company, which launched Navient as a separate entity in 2014, spent about 960,000 in the first few months of 2021. The company lobbied Congress representatives and U.S. officials regarding the “Coronavirus Aid, Relief, and Economic Security Act,” which suspended federal student loan repayments, as well as issues related to federal and private student loan programs, to cancel this law. Sallie Mae Corporation has a history of convictions in cases of student misconduct in loan provision.

NelNet, another company active in providing federal student loans, also lobbied against extending the suspension of student loan repayments. It made significant efforts to cancel the law providing relief and deferral for student repayments during the COVID-19 pandemic in 2020 and 2021. To create its corrupt connections with U.S. government officials to advance its interests, the company spent 230,000 in 2020 and about 110,000 in the first few months of 2021.

Companies’ Contributions to Joe Biden’s Election Campaign

Navient, Sallie Mae, and NelNet have been very generous in sending financial aid to election campaigns. These companies were among the top five contributors in election donations in 2020, collectively paying nearly $400,000 for advertising support to Democrats and Republicans. America’s flawed student loan system has led to increased wealth gaps and racial divides, and it’s currently damaging the entire U.S. economic system. Forgiving student debts is one of the most important actions Biden can take right now to create a fairer economy and address racial inequality. Although he has announced that he will cancel student loan repayments, he explicitly stated that he does not intend to forgive them completely. In February 2021, some Democratic House and Senate members asked Biden to forgive up to 50,000 in student debt through executive order, but he said he could only exempt up to 10,000 for students.

Unprecedented Growth in Student Debt Levels in Recent Years

Since 2004, student loan debt has grown faster than any other type of American family debt, surpassing auto loans and credit card debts in 2010. Overall, this type of debt is the second-largest source of household debt for Americans, with only mortgage debt ranking higher. Today, more American adults are burdened with student loan debt. One main reason for the significant increase in student debt is the financial need for education. In fact, Americans are now forced to take loans to attend university. Over recent years, the percentage of households with student debt has risen from 8% in 1989 to 21% in 2019, nearly tripling. This trend holds for younger households as well; the student debt rate for these households increased from 15% in 1989 to 41% in 2019.

Most outstanding debts belong to graduate students. Average borrowing levels by graduate students have significantly increased over the past few decades. According to the Urban Institute report, between the 1995-96 and 2015-16 academic years, average annual borrowing for graduate students rose from 10,130 to18,210, and average annual loans for undergraduate students increased from 3,290 to 5,460. Overall, graduate student borrowing accounts for 56% of total U.S. student debt.

Unprecedented Growth in Student Debt Levels in Recent Years

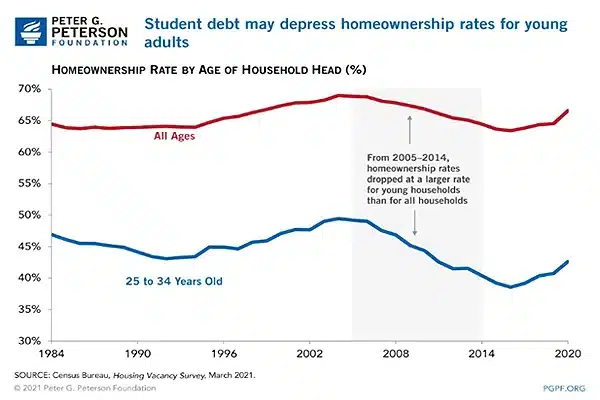

Student debt has adverse effects on Americans’ economic prospects as well. Research by Federal Reserve experts shows that student debt has reduced homeownership rates for American families. From 2005 to 2014, the homeownership rate for all households dropped by 4%, and for households headed by individuals aged 25 to 34 (the majority of students), it fell by nearly 9%. Other research indicates that student debt can affect other aspects of the economy, including hindering small business growth, limiting Americans’ retirement savings, and even delaying marriage and family formation! Costs for obtaining professional and specialized degrees are also rising, leading to increased student debt. In this regard, the Wall Street Journal, citing the U.S. Department of Education, reports that in 2013, only 14 people across America each owed one million dollars or more on their federal student loans. By 2018, this number increased to 101. According to the journal’s report, interest rates for graduate students rose over 6% from 2004 to 2012. The Wall Street Journal cites Mike Meru, an orthodontics specialist, who as of May 2018 had 1,060,945 in student loan debt and is expected to face a 2 million debt in the next two decades. Meru’s situation shows that despite high salaries in this class, becoming a doctor, dentist, or even a lawyer in America today is not a path to wealth.

Unprecedented Growth in Student Debt Levels in Recent Years

Student debt has adverse effects on Americans’ economic prospects as well. Research by Federal Reserve experts shows that student debt has reduced homeownership rates for American families. From 2005 to 2014, the homeownership rate for all households dropped by 4%, and for households headed by individuals aged 25 to 34 (the majority of students), it fell by nearly 9%. Other research indicates that student debt can affect other aspects of the economy, including hindering small business growth, limiting Americans’ retirement savings, and even delaying marriage and family formation! Costs for obtaining professional and specialized degrees are also rising, leading to increased student debt. In this regard, the Wall Street Journal, citing the U.S. Department of Education, reports that in 2013, only 14 people across America each owed one million dollars or more on their federal student loans. By 2018, this number increased to 101. According to the journal’s report, interest rates for graduate students rose over 6% from 2004 to 2012. The Wall Street Journal cites Mike Meru, an orthodontics specialist, who as of May 2018 had 1,060,945 in student loan debt and is expected to face a 2 million debt in the next two decades. Meru’s situation shows that despite high salaries in this class, becoming a doctor, dentist, or even a lawyer in America today is not a path to wealth.

Increase in Interest Rates for Various Student Loans

Another factor intensifying this crisis is the rising costs, indicating that conditions for students in this country will not improve at all. In this regard, it should be noted that the interest rate for new federal student loans for undergraduates in the 2024-2025 academic year will be the highest in 12 years. The federal student loan interest rate for undergraduates will be 6.53%, up from 5.5% this year. Interest rates for undergraduate loans haven’t been this high since the 2012-2013 academic year. Graduate students will also experience an 8.08% interest rate in the upcoming academic year, surpassing the current 7.05%. PLUS loans, available to both parents and graduate students, will be offered at a 9.08% interest rate, a significant increase from last year’s 8.05%.

رژیم اسرائیل با وضع خطوط قرمز برای دسترسی فلسطینیان به غذا، موجب ازبینرفتن امنیت غذایی اونها شده

no comment